Let’s face it. For the last eight or so years, we’ve been pretty spoiled with stock market gains that recovered the losses of 2007/08 and continued to move into ever higher territory. Sure, there were little blips and dips along the way, but we have mostly been spared from major equity market losses for nearly a decade.

As for all good things, bull markets eventually come to an end.

Now, I don’t have a crystal ball, so I don’t know if these recent market losses will be short lived or part of an extended downward trend. But experts are suggesting that volatility in the market (those gut-wrenching swings that take you from euphoria to fear in a matter of minutes) could be the norm for the foreseeable future.

If you are invested in the market, then you are probably already wondering what the future may hold for your retirement portfolio and your kids’ education funds. But, increasingly, home owners and potential home buyers are wondering what this market could mean for their home values or their ability to buy a home in the future.

Interest Rates

Probably the biggest potential impact to homeowners and potential home buyers is the specter of increasing interest rates. The reason the market has reacted so violently in the past week or so was actually because of positive economic news. But that news raised fears that interest rates may go up more the Federal Reserve had previously indicated, in an effort to stave off inflation. This could be bad news for businesses wanting to borrow, but it also potentially impacts mortgage borrowers.

Those seeking new mortgages in the future may find themselves paying higher interest rates, which could in turn reduce the maximum banks will allow them to borrow. Borrowers will pay thousands more in interest over the life of the loan than during more favorable interest rate climates.

Rising interest rates, of course, will also impact people who hold variable rate mortgages, or those who may need to take out a home equity line to make home improvements or complete repairs.

We don’t know yet how much rates may go up. This is key. We still have a couple percentage points to go before we are back to the 6-7% rates that were common in the 90’s. So rates are still low, and now is still a good time to take advantage of lower rates.

Home Prices

If rates should get above 5 or more percent, then we may see buyers start to sit on the sidelines, which could put some pressure on sellers to be more competitive in pricing their homes or make more buyer concessions than they have been accustomed to in the current sellers’ market.

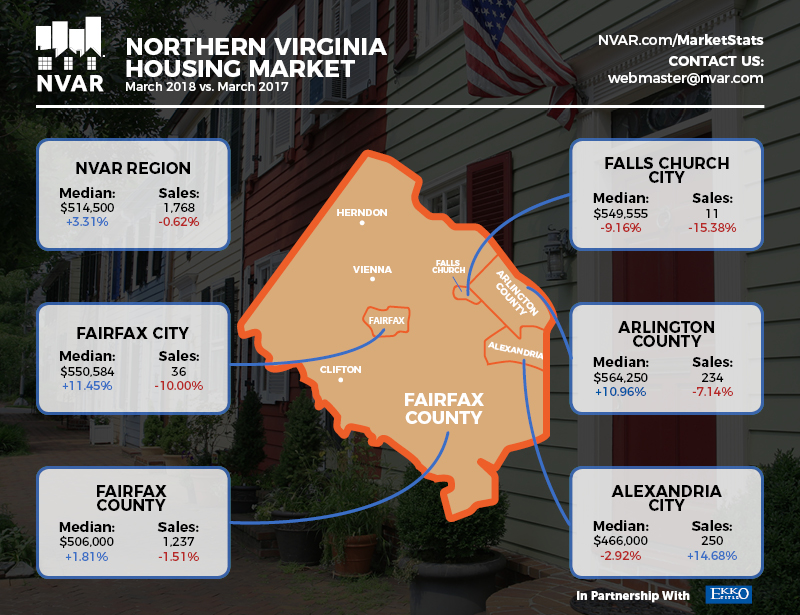

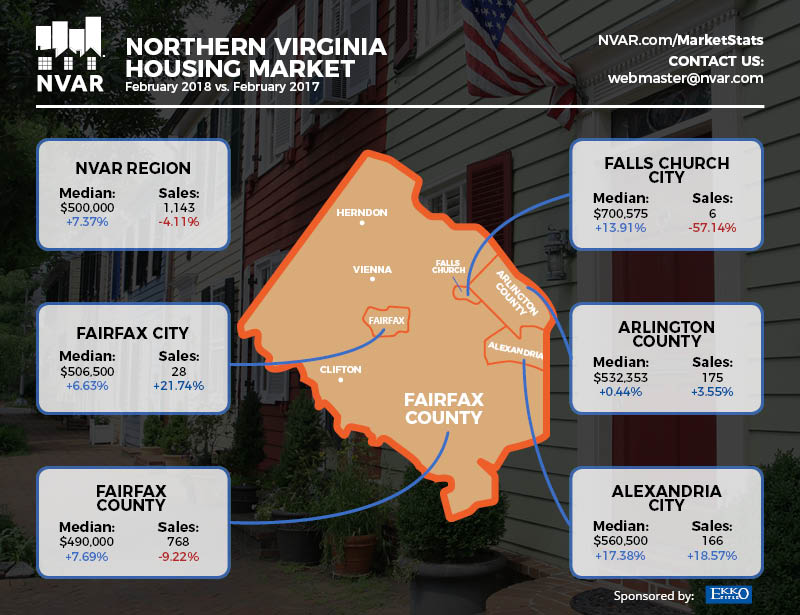

This isn’t necessarily bad for home buyers, though. Here in Northern Virginia and the DC Metro area, we have been in an extended seller’s market, with ever increasing prices. Buyers could enjoy some respite from the need to compete with multiple offers and may even experience some price stabilization. Any price breaks will likely be offset by the higher interest rates, though.

Investment Portfolios

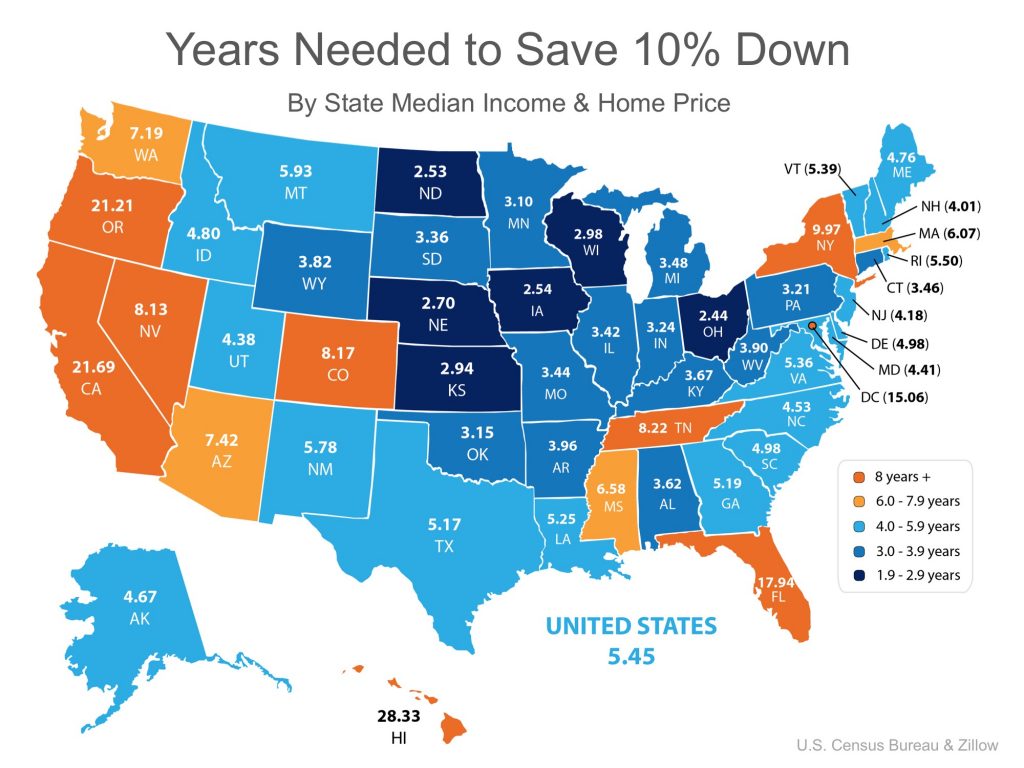

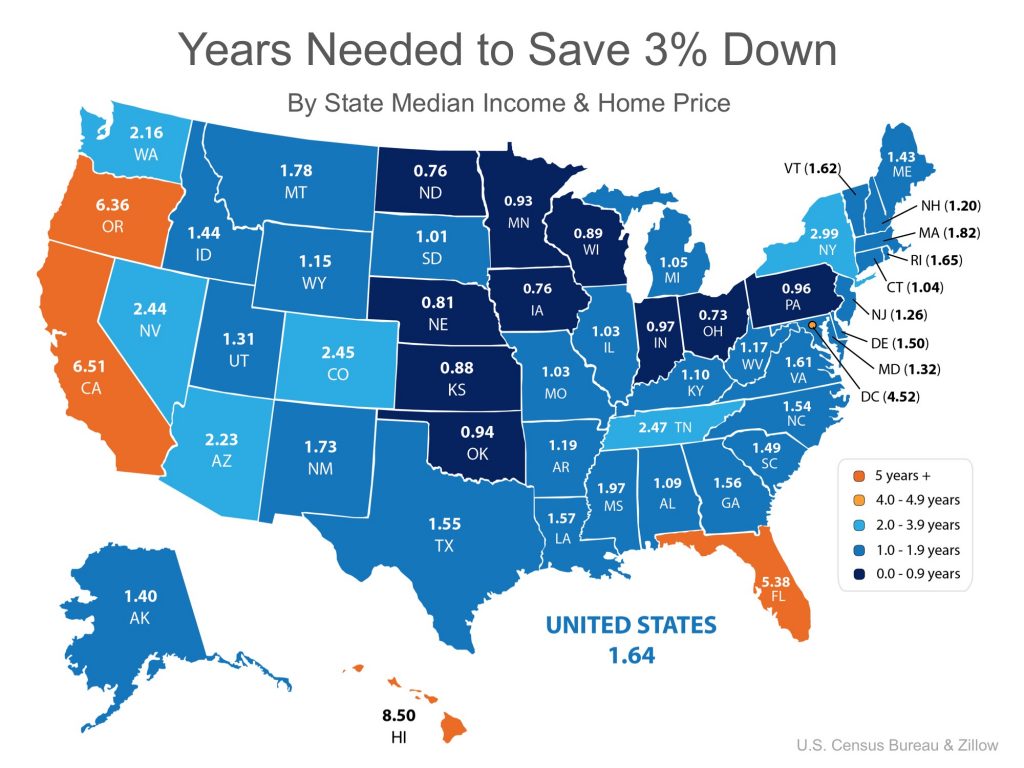

For most people, investing in the stock market is a long-game. Speak to your investment advisor if you have concerns about your overall portfolio balance and the volatility of your individual investments. As your portfolio relates to real estate, if you have your down payment funds for your next home currently invested in in the market, you may want to speak to your advisor about protecting some of those funds against the market volatility or consider interest-bearing vehicles to park your down payment funds until you are ready to use them. This could give you peace of mind to ensure you don’t end up with less funds than you thought you had at closing.

The Nitty Gritty

I have to caveat this entire discussion with the usual disclaimers. We don’t know what future economic data may come out that totally changes the landscape again. This analysis is based on what we know right now, and what we can conjecture based on the facts at hand. Other variables could be rising wages and the as-yet-unknowns of the tax changes that won’t be realized until tax season 2019 and beyond, as well as other economic factors.

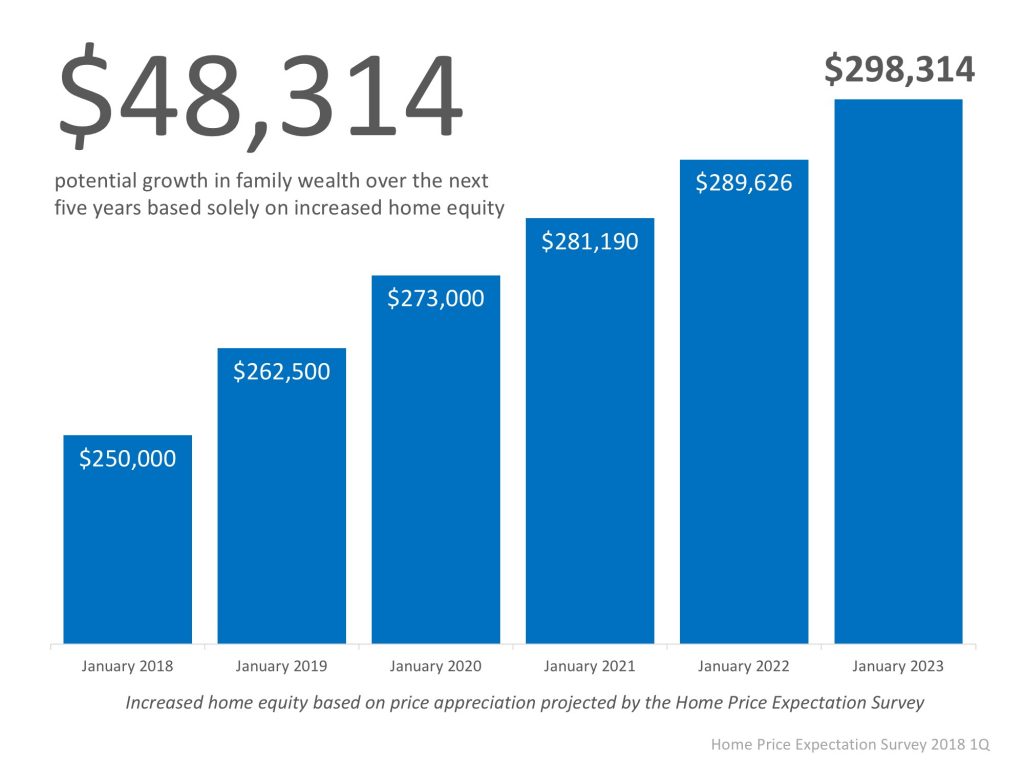

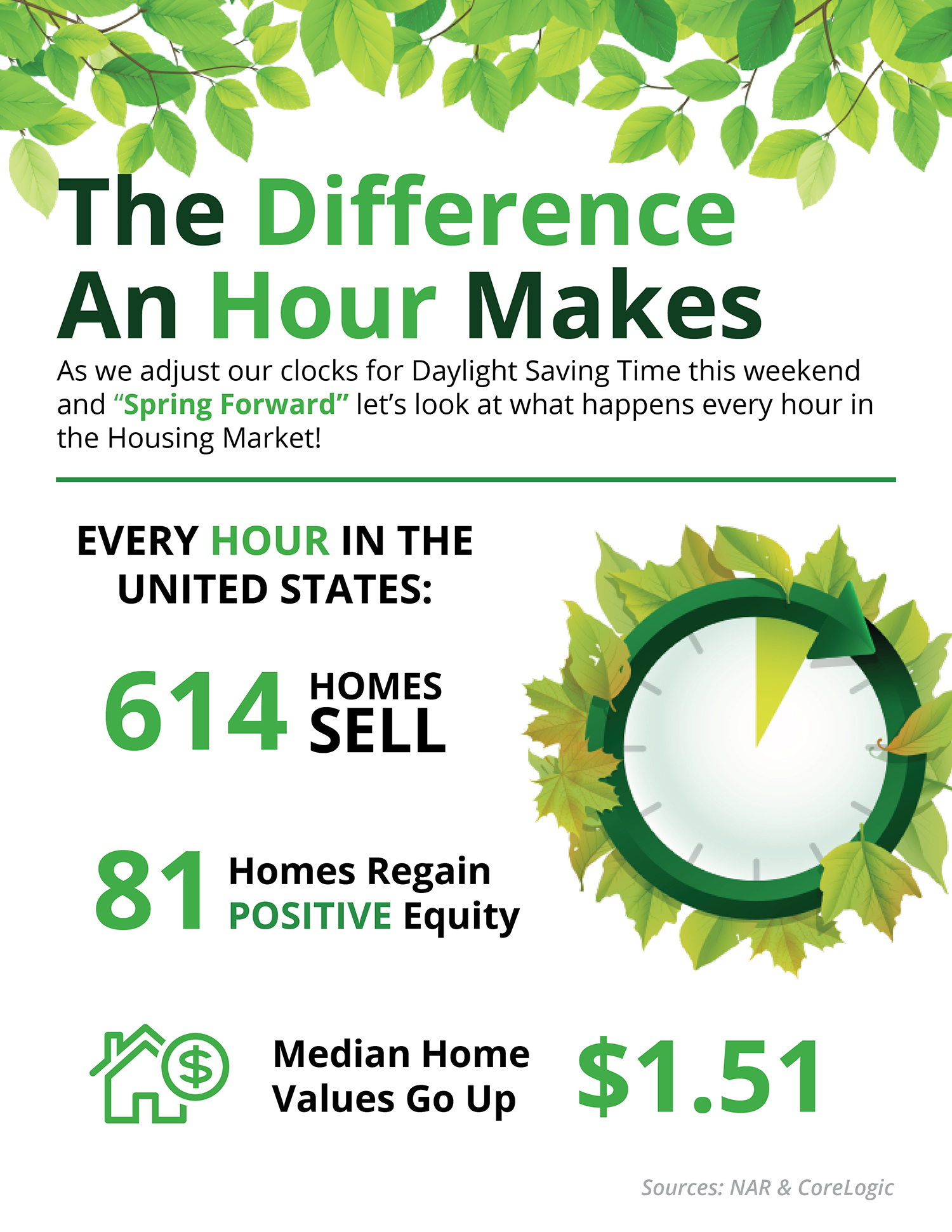

The bottom line is that real estate is a solid investment that typically results in growth of principle over time. If you are thinking of buying a home, you may want to consider taking the plunge before interest rates rise again. If you are thinking about selling, you may want to consider how waiting could impact your ability to attract buyers and your selling price.

Herbert Riggs and Associates can help you with all your real estate needs. Whether buying, selling, or investing, If you have any questions, give me a call at 703-966-2647 or send me an email at Herbert.Riggs@gmail.com.

Read more